Point incentive design

This allocation methodology is subject to minimal change.

LXP-L function

LXP-L is intended to recognize and incentivize meaningful contributors within the Linea ecosystem. These points encompass a variety of actions, such as being an early adopter, owning assets on Linea, engaging with different protocols within the ecosystem, demonstrating past involvement across other blockchain networks, and more.

The overarching function is as follows:

This point formula can be extracted into three terms:

represents the LXP-L user u earns. There are three ways users can earn points:

- Ecosystem Points

- Referral Points

- Veteran Points

Formula explanation

Decay function (DF)

To gradually adapt the number of points and reward early participation in the program, we're employing a decay function that decreases at every Volt (1 month). At the start of the program, this function will be 1, and will be reduced by a factor of 10% after every Epoch, so the overall number of points will be 10% lower every month.

Ecosystem Points

Ecosystem points incentivize onboarding assets onto Linea, along with user activity across various ecosystem protocols. It is calculated as follows:

Where:

- EA is the Early Adopter modifier that serves as a decay function across time

- is the multiplier for passive liquidity

- is the amount of passive liquidity held in wallet

- is the set of DeFi verticals participating in the program

- is the multiplier for vertical v at time t

- is the amount of activity points earned in vertical v at time t weighted by the specific asset class that is in use across the different verticals. Asset classes will come with a different multiplier that will change the value of individual to ensure a healthy ecosystem that is not concentrated in few asset classes (usually ETH/stables).

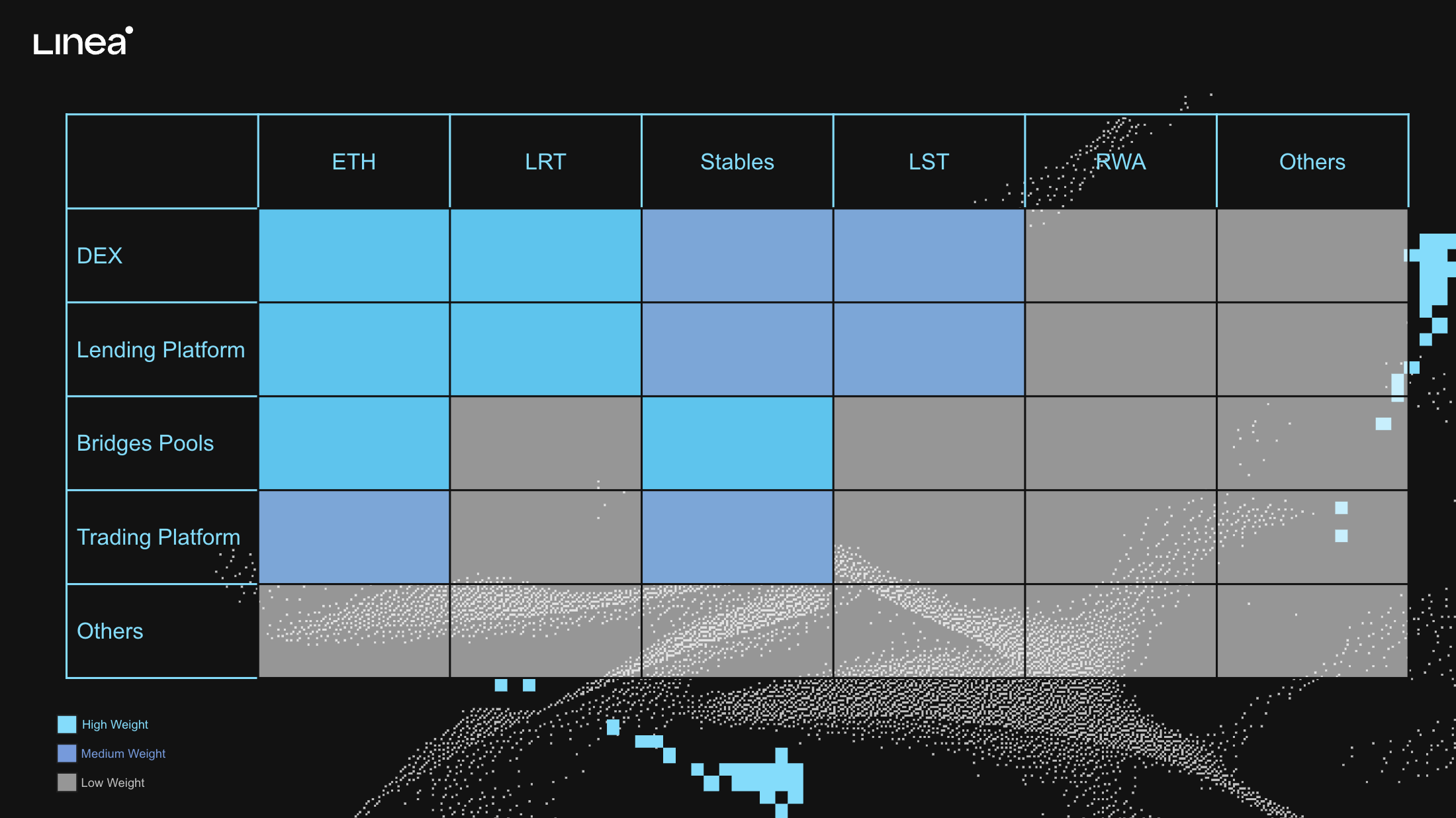

In this specific example—which will apply to Volt 1 at the beginning of the program—we're using the multiplier to maximize the points for ETH and LRT liquidity on DEXs and lending platforms, with a lower weight on stables and LST and a minor weight for RWA and others. We are also maximizing liquidity on third party bridges pools (AMM) for ETH and stables to provide a better bridging experience to users.

Early adopter modifier

EA is the Early Adopter modifier that rewards early activity, defined as activity occurring before the start of the program.

This multiplier will be constant within the time period of a single Volt (1 month) and will reduce over successive Volts. This is used to reward users that have provided liquidity on Linea since mainnet went live and users bridging active liquidity to Linea after the announcement but before The Surge program starts.

The way it works is by looking at historical activity of each address that is eligible to get in the current timeframe:

- EA Multiplier > 1 if:

- The address had at least one active liquidity event across any smart contract on Linea (also the one not included in the program), AND;

- At least one active liquidity event was 0.1 ETH USD (any asset, in dollar value at the time of the liquidity event).

- EA Multiplier = 1 if:

- The active liquidity event happened after the start of the program

- The active liquidity event was < 0.1 ETH USD

- All other cases

The EA multiplier will start at 1.5 at the beginning of the program and will be reduced at the end of each Volt, before reaching the value of 1 for the rest of the program:

| Volt | EA multiplier |

|---|---|

| Volt 1 | 1.5 |

| Volt 2 | 1.3 |

| Volt 3 | 1.2 |

| Volt 4 | 1 |

| Volt 5 | 1 |

| Volt 6 | 1 |

DEX objective functions

For Linea's DEXs, we've implemented a points incentive program tailored to recognize and reward active liquidity providers for their crucial role. In this program, user points are calculated from the market depth of their liquidity positions and factoring in the respective pools' realized volatility. This methodology ensures that points are accrued per block at a rate proportional to the effectiveness of the liquidity provided. In essence, the deeper the market depth from your liquidity position, the greater the accumulation of points.

Market depth for some percentage X% is calculated for a given user, pool, and block as the USD value of the liquidity in range X% above and X% below the active price of the pool. This function is formulated for various AMM structures to use the appropriate price impact mechanism for each. With this definition of market depth, we define the market depth score as a weighted average of market depth at several realized volatility levels (RV30, 2RV30, and 3RV30), with weights that reflect the likelihood of the given price being reached. It is the measure of liquidity across a certain price range, adjusted for the past volatility of the token pair. At each block, users will gain points according to this market depth score.

This system is designed to fine-tune liquidity provision across different asset types: in a concentrated liquidity market maker for example, the methodology requires tighter allocations for stablecoin pools to reflect their lower volatility, while allowing for broader allocations in more volatile pools. Our aim is to optimize liquidity throughout the ecosystem, thereby minimizing price impact for all DEX users. By participating, liquidity providers not only enhance their rewards through a more strategic allocation of their assets but also contribute to the overall health and efficiency of the market.

Lending objective functions

For lending protocols, our objective function prioritizes tokens supplied and the total revenue to suppliers from lending interest.

is a parameter that sets the value of income relative to value supplied. To handle income in a symmetric way across verticals, it is the same used in the DEX objective function.

We distinguish supplier revenue from interest to exclude supplier revenue from Linea incentives. We also exclude any and all recursive borrowing, both for its impact on supply and its impact on interest payments.

Recursive borrowing is borrowing a token using the same token as collateral. Although lending protocols allow this, it is not an intended use case. The user will always pay a higher interest rate on their borrowed tokens than they receive on their supplied tokens, essentially gifting money to the protocol for no gain.

However, when incentive programs pay users for the value they supply, it can make recursive borrowing profitable. In many past incentive programs, users have opened recursive borrow positions to farm incentives, removing them all when the incentive program ends.

To avoid this, we simply exclude all recursive borrowing, counting only the net value of each token supplied by a given account. We also subtract the share of interest paid by recursive borrowers from the supplier revenue. This makes the recursive strategy unappealing, and we do not expect any users to attempt it.

Decentralized trading objective functions

Taker incentives

Trading incentives are set with the following equation:

The trader incentives allocated to user i are weighted by the user’s share of total trade volume. However, each user cannot receive more incentives than the total amount of trading fees they paid during the grant period. Incentives that would exceed fees are redistributed to the rest of the trader pool. If total trading fees are less than the total trader incentives, extra incentives will be rolled into the next grant period.

Maker incentives

We define the market depth score in the same way as the DEX liquidity section.

Bridge liquidity objective functions

Third-party bridges typically operate by facilitating the exchange of wrapped versions of assets like ETH and stablecoins, transitioning them onto Linea where they are exchanged for the original assets. This process relies on substantial liquidity pools within automated market makers (AMMs) to ensure efficient swaps with minimal slippage.

Similar to the DEX section, points will be allocated based on a market depth score to improve liquidity and minimize slippage for meaningful pairs.

Objective functions for other verticals

For all other types of protocols, we leverage TVL as the primary metric to allocate points.

Referral points

Referral points incentivize cooperative onboarding activities. These points are calculated by the formula:

where:

- is the total referral points earned by user u

- is the multiplier for referral activity

To obtain the total referral points earned by user u, we sum over eligible points generated by r wallets that have activated user u's referral code.

Eligible points are points generated through on-chain wallet activities and, to prevent second-order referral effects, do not include referral points. The referral multiplier is optimized throughout the program to incentivize early onboarding efforts and adjust for network growth.

Veteran points

Veteran points and the multiplier provide additional points to users who have demonstrated notable activity and partnership in the past, inviting active blockchain participants to join the Linea network.

This is a recurring function of ecosystem points, acting as an additional multiplier only for a specific list of addresses provided by the Linea team.